Personal Information Collection Statement

Purpose of Collection

The personal data provided in this questionnaire will be used by the Customs and Excise Department for one or more of the following purposes:

- Considering and processing applications for the Registration Regime for Dealers in Precious Metals and Stones;

- Sending the relevant information of the Registration Regime;

- Discharging various duties and functions of the Customs and Excise Department; and

- Facilitating communications between you / your company and staff members of the Customs and Excise Department.

Access to and Correction of Personal Data

- Under the Personal Data (Privacy) Ordinance, you have a right of access to and correction of your personal data. Your right of access includes the right to obtain a copy of your personal data provided in this questionnaire. In accordance with the terms of the Ordinance, we have the right to charge a reasonable fee for the processing of any data access request.

- Enquiries concerning the personal data collected by this questionnaire, including the request for access to and correction of personal data, should be addressed to:

Mail: Customs and Excise Department

Office of Departmental Administration

Executive Officer (Personnel)3

31/F, Customs Headquarters Building

222 Java Road, North Point,

Hong KongTelephone: (852) 3759 3841 Fax: (852) 3108 2305

Declaration

Applicant's Information

Disclaimer

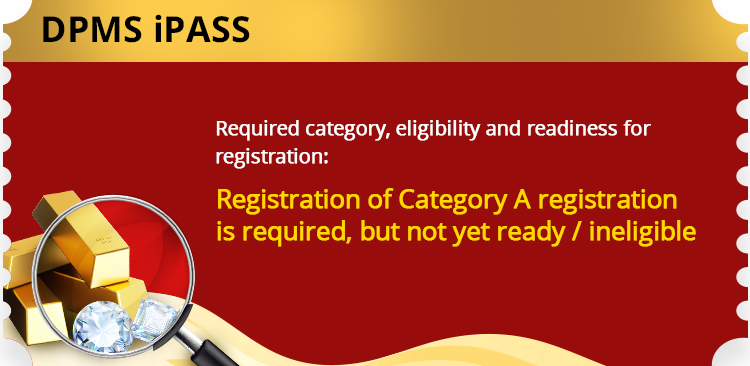

The result generated upon completion of assessment is for reference only and subsequent application result is not guaranteed. When the Commissioner of Customs and Excise considers the registration application, the Commissioner will take into account a range of factors, including but not limited to matters listed in AMLO and the Registration Guide.

Whether registration is required and for which category of registration shall be applied?

Readiness of the precious metals and stones dealer for category A registration application

Readiness of the precious metals and stones dealer for category B registration application

You have completed the self-assessment. Thank you.

The dealer is recommended to apply for registration as early as possible.

Improvement on eligibility and readiness for registration is needed. Please refer to the following recommendations:

| Requirement | Recommendation |

|---|

The dealer is recommended to apply for registration as early as possible.

Improvement on eligibility and readiness for registration is needed. Please refer to the following recommendations:

| Requirement | Recommendation |

|---|